The term “house hacking” was coined by Bigger Pockets, and it basically just refers to buying a residential real estate property and living in part of it while renting out the rest of it. It’s also called “home sharing”, or an “owner-occupied rental.” It’s a popular way to get started in rental real estate, or just a great way for anyone to generate extra income.

These are some examples of ways to do house hacking:

- Buy a multi-unit property like a duplex or triplex and live in one of the units.

- Buy a house and have roommates.

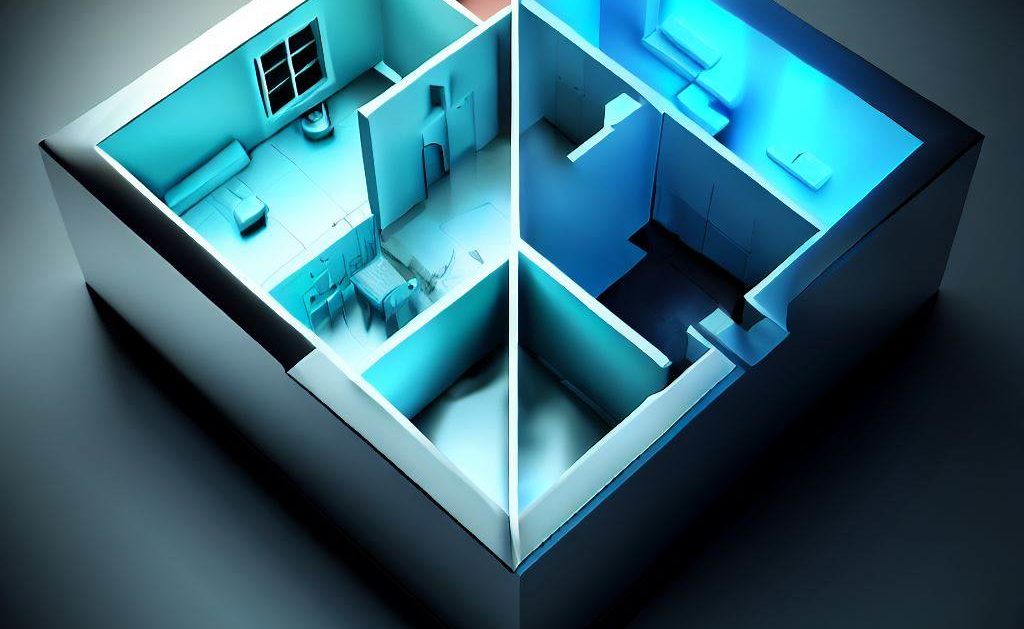

- If you don’t want to share common space with roommates, you can buy a house and subdivide it and just rent out some of the rooms separately. This can work if the layout of the house makes sense for it, such as if there is a separate entrance and a way to section-off one or more rooms (with a bathroom). For kitchen facilities, you can just set up some space with a small fridge, microwave, and a toaster oven, and that is adequate for people who don’t require a full kitchen.

- There is also “co-living”, which is essentially just a house with roommates, but usually on a larger scale with more than a few rooms (often involving sub-dividing large rooms into smaller rooms).

Renting for 14 Days or Less

If you rent out any property for 14 days or less in total for the year, you don’t have to report the income or pay any tax on the income. But if you rent any property, including part of your home, for more than 14 days, then you have to report that income on your taxes.

Dividing Your Expenses

The first step is to determine what percent of your home is designated for personal use and what portion is the rental.

Under section 280A of the tax code, common areas that you also use are considered part of your personal space and unfortunately aren’t counted as part of the rental space in the proportion calculation. It may make logical sense that you could count half of the common space when you’re splitting a two-bedroom house with a roommate, but unfortunately the tax code doesn’t allow that.

Treasury Regulations section 1.280A-2(i)(3) suggests a couple of ways you can proportion the rental portion of a property, but the most common method is using the square footage.

An alternative option is to calculate the rental portion by the number of rooms, but this isn’t applicable to most homes. It doesn’t mean bedrooms, it means the number of rooms of any kind, including kitchen, living room, bathrooms, etc. And it only applies if the rooms of the house are of “approximately equal size”. Most houses don’t have living rooms and bathrooms that are the same size as the bedrooms, so this method tends to not be applicable to most homes. Using the square footage is less ambiguous, and less likely to be something that could be disputed.

Calculating Expenses

The rental percent you calculated above will be used to calculate what portion of your home expenses can be deducted on your Schedule E as rental expenses. Your tax software may ask for the percentage of rental use of your home and do the calculation for you, or you may need to do the math yourself and then enter the result. Expenses that are proportioned for the rental percent of your home are called indirect expenses, and expenses that are entirely just for the rental are called direct expenses.

For example, if you’re renting out 50% of your home and the utility bill is $100, then you would be able to report $50 as a rental expense on your Schedule E. By the way, if you charge your roommates for utilities, you would still report that same amount as an expense. But you also have to include the amount they pay for utilities in your total reported rent income amount.

You can deduct the rental percent of most expenses related to your home including mortgage interest, property taxes, utilities, landscaping, and cleaning products. Note that if you use itemize deductions (Schedule A), and you claim a tax deduction for your mortgage interest, you can’t “double-dip” and also claim a tax deduction for the mortgage interest that you are partially claiming as a rental expense. So you would have to enter only the personal portion of the mortgage interest for your personal tax deduction.

You can’t deduct an expense if it applies only to your personal portion of the property (such as landscaping for a backyard that you don’t share with tenants). And you can fully deduct expenses that are entirely for the rental portion of the property (such as supplies you buy for the rental).

Deductions Limited when Renting Rooms

If you’re renting out rooms in your home and the rental portion isn’t a separate dwelling, your deductible expenses are limited to the amount of rental income (under § 280A(c)(5) of the tax code. There is an exception for short-term rentals (under § 280A(f)(1)(B) and § 1.280A-1(c)(2) of the tax code and treasury regulations).

Because you have personal use of the same dwelling (aside from the exception for short-term rentals), then the personal use rules apply, and the expenses you can deduct are limited to the amount of rental income you receive. Any additional tax loss is does get carried forward to future tax years as a “carryover of unallowed expenses,” where it can potentially offset future income from the same property if the future income exceeds the expenses in that future tax year.

Deductions Limited by Personal Use

There are limits on deducting rental expenses if you have a property that you use for personal use part of the year, and as a rental during other times of the year. If you use the rental space for personal use more than 14 days in a year (or 10% of the days if you didn’t own it for the whole year), then the deductibility of your rental expenses are limited to the amount of your rental income (so you can’t report a rental loss). See IRS Publication 527 for the specific calculations on worksheet 5.1. Any days before you first started renting it out for the first time don’t count as personal use days. Any time a rental is rented below market value, that is also considered personal use.

Depreciation

When you use part of your home as a rental, you claim part of the cost of the house as “depreciation,” which means you get to deduct a portion of the cost of the house from your rental income each year, which reduces the amount of taxes you have to pay on that rental income.

The basis for claiming depreciation is the fair market cost for the portion of the house that you are renting out (just the building itself and any land improvements, but not the land itself). So if you are renting out half of your house, the basis for claiming depreciation would be half of the fair market value of the house (without the land). If you don’t have a recent appraisal, you can use values from your county’s property tax records if they report the building and land separately, as many do. For more information, see our article on depreciation.

Frequently Asked Questions

Can I still take the home office deduction? Yes. That space just can’t overlap with the portion you are designating as rental space, it would have to be allocated from your personal portion of the home.