Original price was: $99.00.$69.00Current price is: $69.00.

Description

Brand new for 2026! Up to date with the latest form 3115 procedures following the latest methods outlines in IRS Rev. Proc. 2022-14.

This is a complete tutorial on how to use Form 3115 when you need to apply a cost segregation study to a rental property that was placed in service in a past year. If you have a rental property and you have already filed one or more tax returns using the original depreciation method, then this is the process you need to now apply the cost seg study.

This downloadable product includes everything you need to fill out the form plus the required attached statements and a spreadsheet to calculate the changes in the depreciation schedule. It includes information on filling out the 3115 directly as a PDF, and filing instructions for tax software, including TurboTax, TaxAct, etc.

This download is a zip file that includes these items:

- A 28-minute instructional walk-thru video on how to complete the forms and the rest of the filing process.

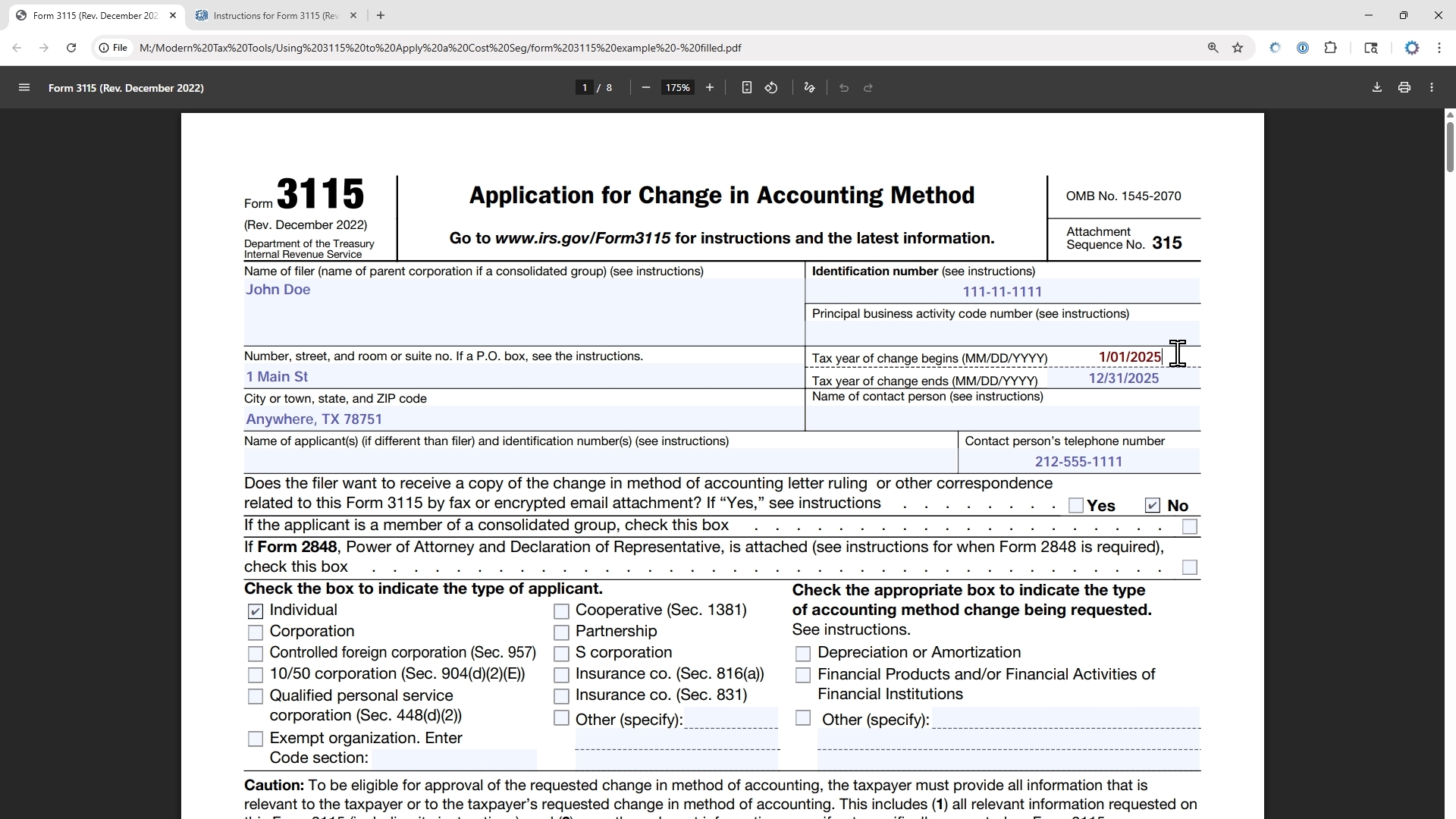

- A fillable PDF Form 3115 that is already filled out as an example to apply a cost seg study. Just add your changes and it’s ready to submit.

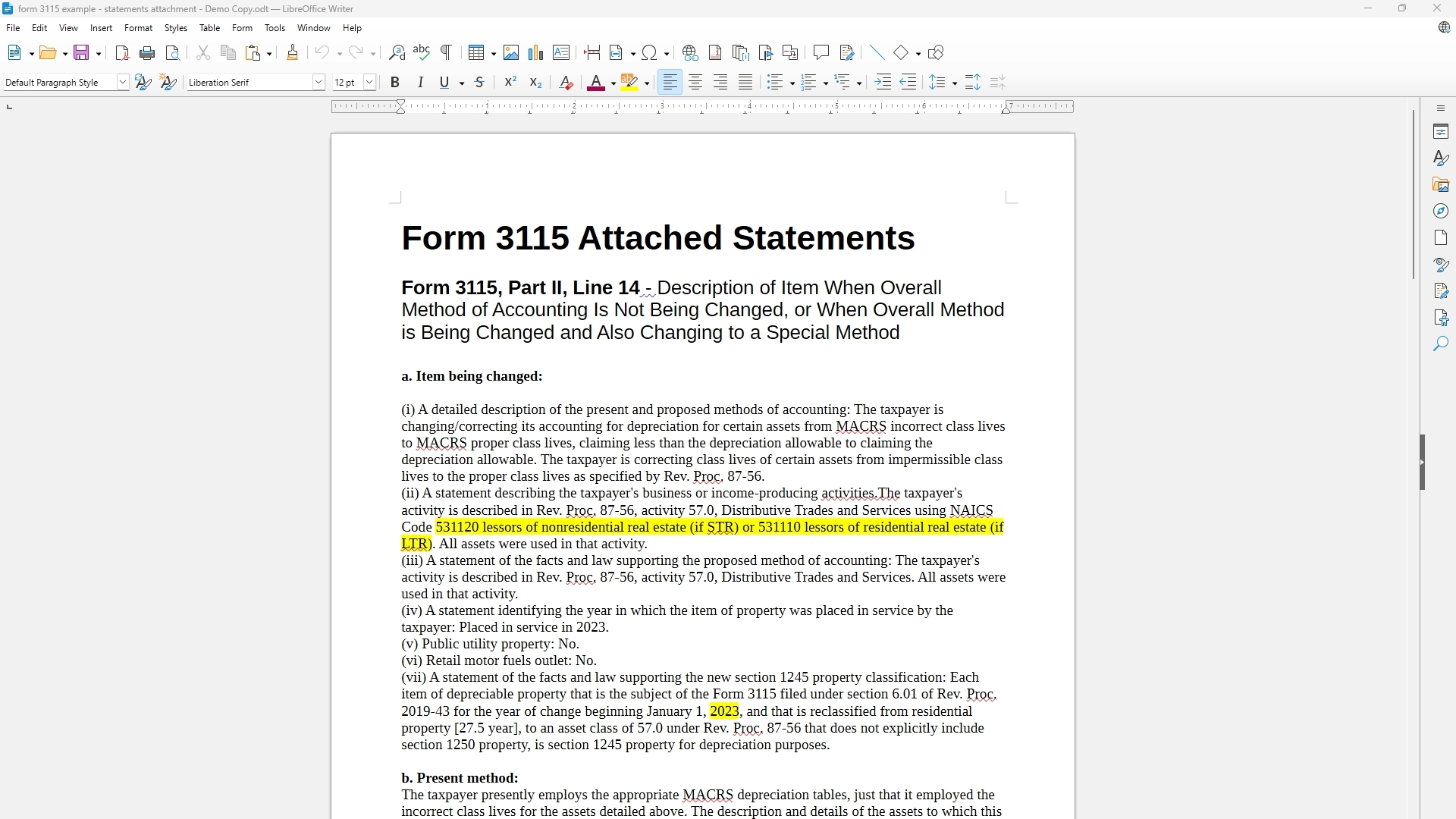

- Required statements to attach to the 3115 (in Word and LibreOffice Writer formats).

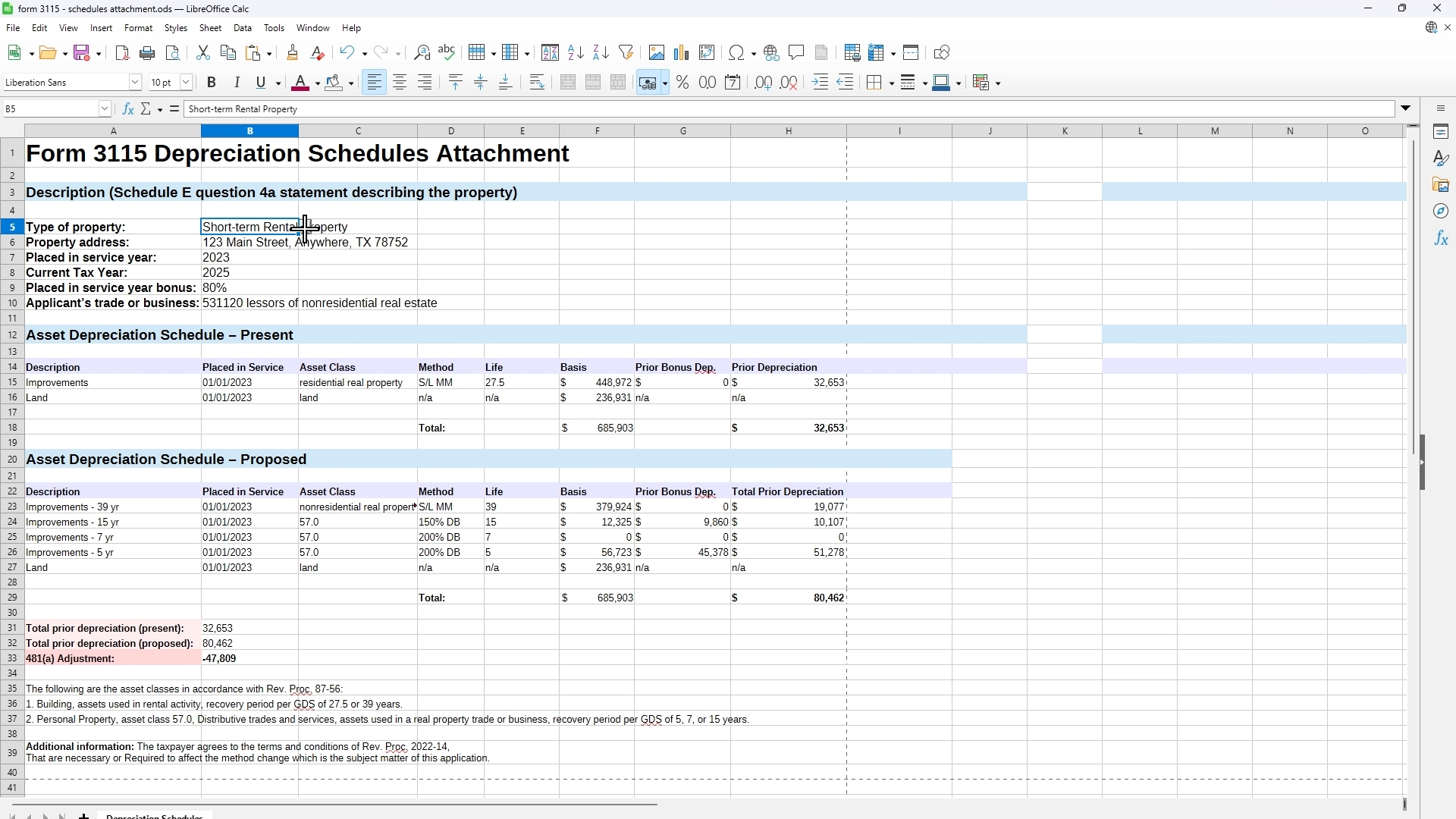

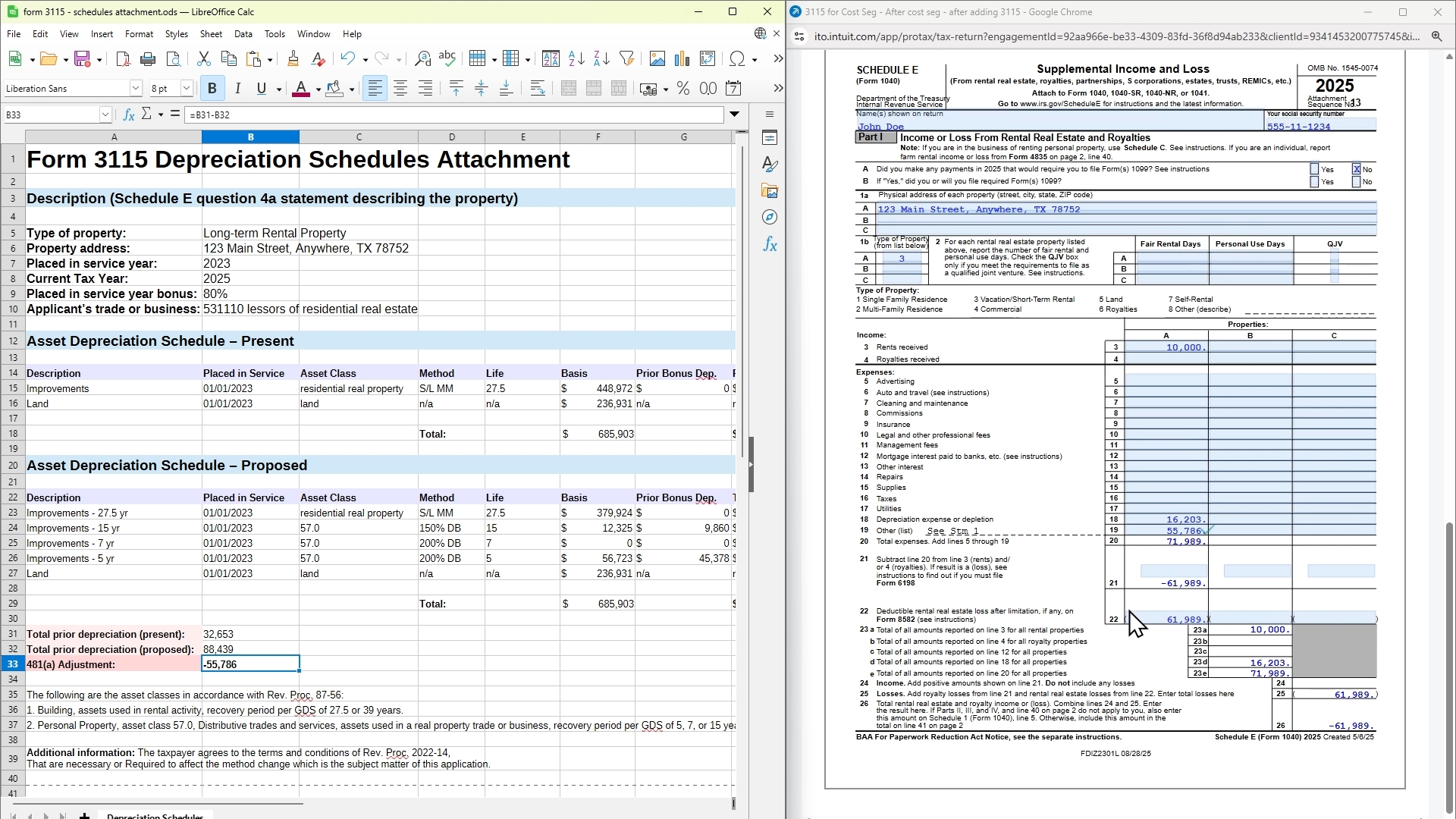

- A spreadsheet to calculate the depreciation schedule changes (in Excel and LibreOffice Calc formats).

This is everything you need to complete the process to use to apply a cost segregation study to a rental property that already has been in service for a number of years.

Reviews

There are no reviews yet.